If I Transfer Money Through Xoom From My Credit Card, Is It A Purchase?

The Apple tree Carte credit carte was introduced in August 2019. It apace generated plenty of interest, especially among millennials, who comprise seventy percent of Apple Carte du jour holders, co-ordinate to Forbes. A total of 3.one million people got the card after it became available to the public, and six in 10 of those surveyed said that the Apple tree Card was their primary credit card.

In that location are some definite perks, peculiarly for Apple fans. All the same, as with whatever credit menu, in that location are some potential drawbacks to be aware of as well. Read on to notice the pros and cons of the Apple Card as you decide whether the card could brand a sensible addition to your wallet.

How Is the Apple Credit Menu Different From Other Credit Cards?

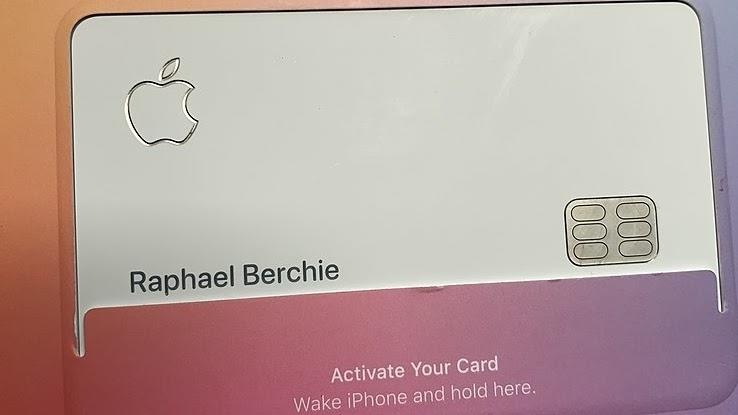

One glance at the Apple Menu reveals an obvious difference between it and others on the market today. That is, you won't find a number anywhere on the menu. Instead, every payment requires your device number along with a single-use code that's authorized via passcode, Confront ID or Touch ID.

If you do need a number, though, you can access information technology through Apple tree's Wallet app. In that location, you lot'll find the number forth with an expiration date and security lawmaking. As an added bonus, y'all can merely freeze the bill of fare and enquire for a replacement via the Wallet app.

What Are the Benefits?

Instead of a traditional cash dorsum setup, yous get a percentage of every purchase back in the form of Daily Greenbacks. The greenbacks is practical directly to your card on a daily basis, and there'due south no limit to the amount of Daily Cash yous can earn. You lot're free to spend the cash however y'all like.

Apple also tries to reduce fees on its credit carte du jour equally much as possible, which is why you won't run into whatever annual or belatedly fees. That's right — you don't have to worry most your rates going up even if y'all miss a payment. Instead, y'all accumulate involvement owed at a set if yous don't pay your monthly balance. Apple fifty-fifty shows you how much you'll owe later depending on how much yous chose to partially repay. Apple Card payments are always made on the last day of each month. Yous can set reminders along with weekly or bi-weekly payment plans.

Apple's goal is to make your purchases more transparent, in part by using Maps and so that yous can see exactly when and where each payment was made. You lot tin can easily keep tabs on all your food and drink purchases, as well as entertainment-related expenses, such equally movies and concerts. While this carte du jour is intended for apply with Apple tree, companies owned by Apple tree and stores that take Apple tree Pay, you'll yet become ane per centum Daily Cash back if you lot make a purchase in a store that doesn't however support Apple Pay.

Whatever Drawbacks?

At that place are better credit cards available if you're mainly interested in a good cash dorsum rewards credit card. With Apple Card, yous can't choose your preferred categories, and the highest cash back earning potential is express to purchases made directly from Apple and a select number of companies, including Uber and UberEats, Walgreens and Duane Reade. Every Apple Pay purchase nets an additional two percent cash back, while you get one pct cash back on all boosted purchases fabricated with your card.

If you don't always have your phone handy or tin can't access your Wallet, making payments with this credit carte du jour can be downright challenging. Y'all as well need to open Wallet to access information such every bit your credit card number, security code and expiration date. Some other drawback is that Apple tree Pay isn't available everywhere. Finally, co-ordinate to Apple tree, your application could be declined if your FICO9 score is under 600.

Source: https://www.askmoney.com/credit-cards/is-apple-credit-card-worth-it?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: lucasdocials.blogspot.com

0 Response to "If I Transfer Money Through Xoom From My Credit Card, Is It A Purchase?"

Post a Comment